Love Art? Have an ABN?

This financial year = 100% tax deduction on artworks! BUT - this is ending JUNE 30 2025!

Read on art lovers :)

The 2025 Federal Budget has confirmed the end of a popular tax break for small businesses — the instant write-off for artwork purchases up to $20,000. This handy perk, first introduced back in 2015 as part of the Small Business Measures, will officially come to an end on 30 June 2025.

The 100% depreciation for artworks applies to a person carrying on a business with their own ABN, for example lawyers and doctors, tradies, shopkeepers and basically everyone who doesn’t work for the government.

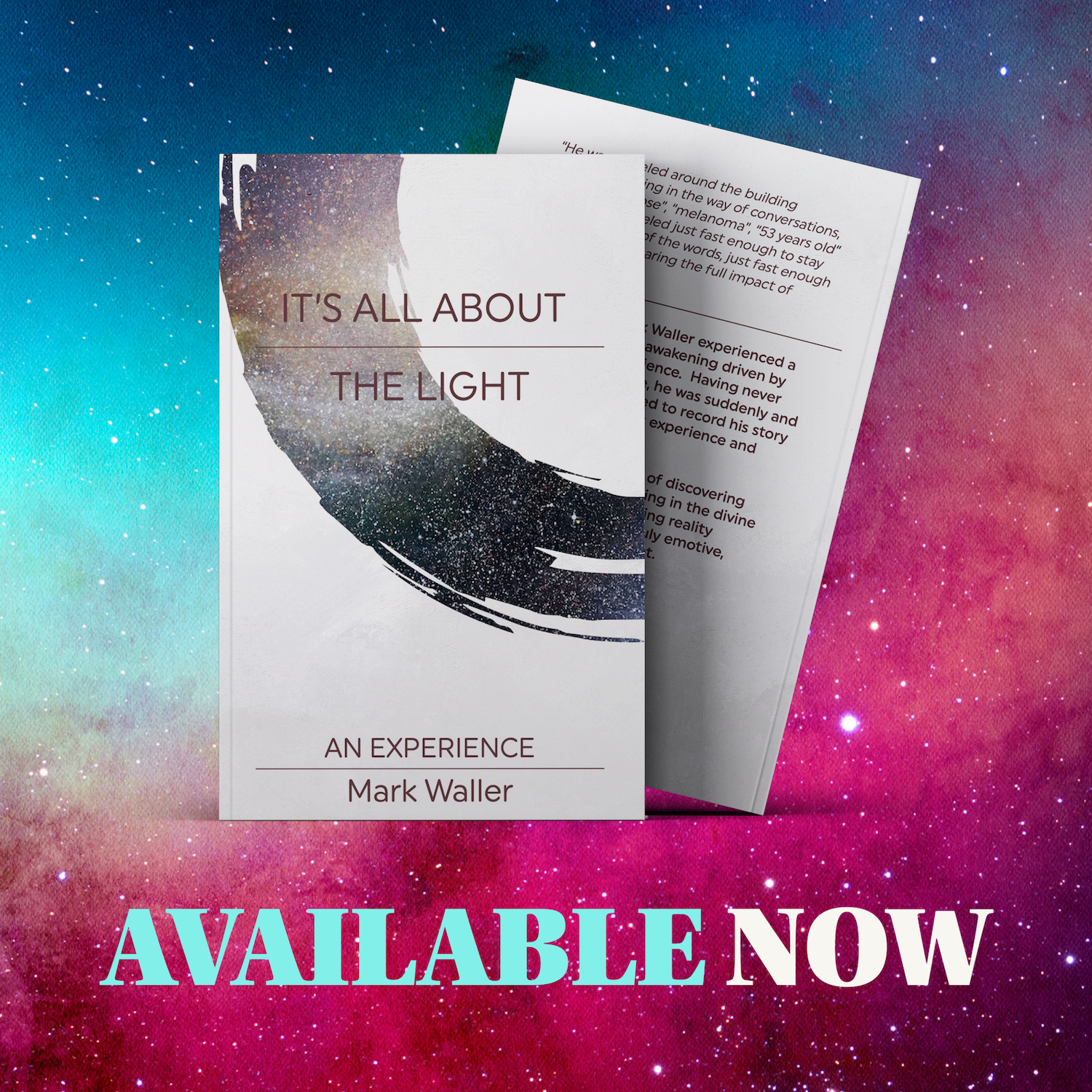

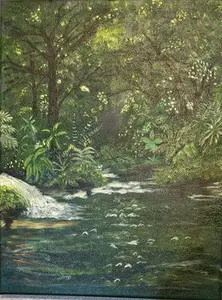

Grab one of these beauties now!

How Does the Artwork Tax Deduction Work?

If your business has an annual turnover under $10 million, you can currently claim an immediate deduction on eligible assets under $20,000 — including artwork. That means if you buy a qualifying piece of art for your workspace, you could write off the full cost straight away. But only until the end of June 2025.

There is no limit on the number of artworks that may be purchased and depreciated at 100%, up to the value of $20,000. Several works of different artists, and several works of the same artist might be purchased. Incredibly, this announcement applies to both old and new artworks.

They must have been purchased between 12th May 2015 and 30th June 2025 to qualify for the 100% depreciation concession.

This tax allowance for small business means there has never been a better time to buy art for your office or business premises!

Is My Business Eligible?

If your business has an aggregated turnover of less than $10 million, you might be in luck. According to the ATO, for an artwork to qualify, it must:

• Be a physical (tangible) item

• Be bought mainly for use in a business setting

• Be movable

• Not be trading stock

Just a heads-up: NFTs don’t count for this deduction.

What Should I Do Next?

Thinking of upgrading your workspace with some new art? Have a chat with your accountant to make sure you’re eligible — and don’t leave it to the last minute. To qualify for the write-off, your artwork needs to be purchased by 30 June 2025.